PCI Pal

The PCI Pal mission is to safeguard reputation and trust by providing organizations globally with secure cloud data protection and omnichannel cloud payment solutions for any business communications environment.

Overview

Ready to protect your customers’ payment data, boost your customer experience, and simplify PCI compliance? Use PCI Pal’s® patented technology to take secure and compliant payments within Vonage Contact Center. Now you can offer customers different payment methods across multiple channels to suit their needs — all in one seamless journey. Agents and networks are de-scoped from the requirements of PCI DSS while supporting each payment journey in real time.

Cloud-native architecture protects merchants from data leak threats and compensating controls — such as pause and resume — seen with alternative providers.

Solutions

Agent Assist

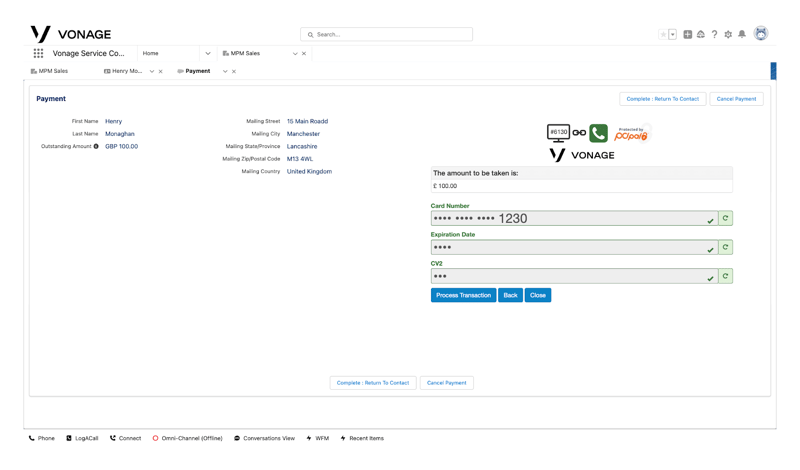

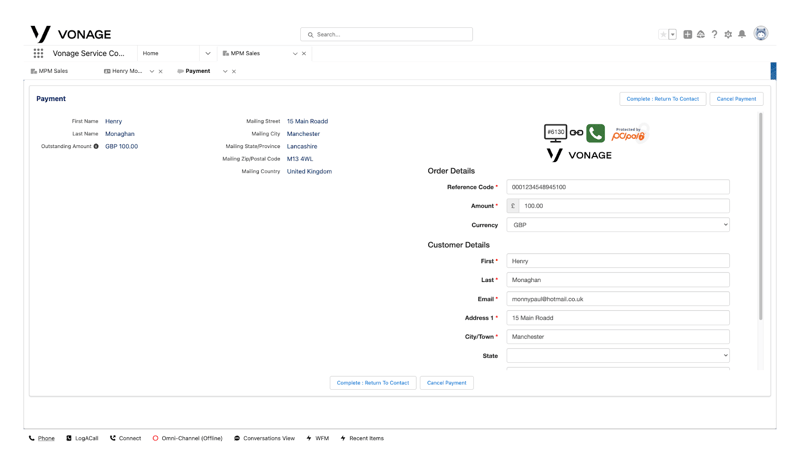

This PCI compliant solution for live calls uses Dual Tone Multi Frequency (DTMF) masking technology and speech recognition to provide a secure way of handling payments by phone, without bringing your environment in scope of PCI DSS. The solution integrates with the call flow at point of payment and intercepts the customer’s financial details, which helps to maintain call integrity.

IVR Payments

Conveniently allow payments to be taken securely 24/7 without needing an agent. PCI Pal simply integrates with your existing IVR flow or assists at the time of setup.

Speech Recognition

This feature improves the accessibility of both Agent Assist and IVR Payments. This is especially helpful when customers cannot access a phone keypad or multi-language payments may be needed. Sensitive card information can still be collected securely.

Digital Payments

You can enjoy Digital Payments as a standalone feature or combined with Agent Assist — and make secure omnichannel payments possible for your contact center. Agents send digital links through channels such as webchat, WhatsApp, video, social media, email, or SMS. Customers can choose from a number of payment methods alongside cards, including account-to-account payments with pay by bank — which offers true payment flexibility for customers and minimizes the cost of taking payment for merchants.

The right fit

PCI Pal solutions are:

Customizable to your business and industry

Scalable to grow with you

Cloud based and reliable

Secure with Level 1 PCI DSS certification

Easy to integrate with existing payment providers, phone systems, and telecoms platforms

Available globally within the PCI Pal platform, so your agents can accept payments from customers through any channel

Benefits

Seamless integration

The PCI Pal integration is quick and seamless, and works with Vonage and other infrastructures already in place. PCI Pal is PSP agnostic and takes the hassle out of implementation with a “go live framework.”

Reduced call times, with increased conversion and revenue

A seamless PCI Pal integration means less drop off and reduced transfers. And this improves customer satisfaction through a modern payment checkout … not to mention increased conversion with speech and alternative payment options.

Enhanced customer experience

Customers can choose from a number of card payment methods — giving them freedom over their finances and providing a modern, seamless checkout experience. Agents can also follow payment journeys in real time, regardless of the channel or payment method chosen.

Security

The PCI Pal patented, secure cloud payment solutions are certified to the highest level of security. PCI DSS Level 1 compliance safeguards your reputation and trust and ensures that no customer financial information reaches your network, which secures you and your agent against fraud.

Best for your business and customers

Vonage Contact Center can provide these offerings — built around your contact center and processes — to ensure that you operate in the way that is best for your business and customers.

.png)